About Us

Claim Genius, LLC was founded in 2022 by Jordan Quiroz, who brings over a decade of experience as an insurance adjuster. With five years specializing in fire and water damage, Jordan holds IICRC certifications in these areas and is an expert in handling large loss commercial and complex claims. His extensive background has seen him successfully negotiate millions of dollars in property damage settlements.

Get a free Case review

Our Services

We specialize in handling residential claims with precision and care. Whether it’s damage from a storm, fire, or water, our experienced adjusters ensure you receive the maximum settlement for your loss. One of our notable successes includes securing a 550% increase in their claim payout for a homeowner after a devastating fire, far exceeding the initial offer from the insurance company.

Our expertise in commercial claims allows us to manage complex and large loss scenarios effectively. We have a proven track record in securing substantial settlements for businesses, ensuring minimal disruption to operations. For instance, we successfully negotiated a $2.5 million settlement for a commercial property owner after extensive storm damage, significantly above the insurer’s initial assessment.

Navigating insurance claims can be daunting, but our seasoned negotiators make it straightforward. We leverage our deep understanding of policy language and claim processes to advocate fiercely on your behalf. A remarkable achievement in our negotiation history includes obtaining an additional $480,000 for a policyholder in a disputed claim that was initially denied.

Accurate documentation and meticulous preparation are crucial for a successful claim. Our team excels in compiling comprehensive claim packages that leave no detail overlooked.

How It Works

Initial Consultation

We start with a free evaluation of your claim to understand the details and scope of the damage. This allows us to formulate a tailored plan for your situation.

Preparing the Sworn Proof of Loss

We prepare a sworn proof of loss, ensuring all necessary information is included to comply fully with your policy requirements. This document is crucial for substantiating your claim.

Documenting the Damages

Our team meticulously documents all damages. We take comprehensive photos, videos, and notes to provide clear evidence of the loss.

Preparing a Detailed Estimate

We create a detailed estimate of the damages, itemizing all necessary repairs and replacements to ensure no aspect of your loss is overlooked.

Submitting the Sworn Proof of Loss

We submit the official sworn proof of loss to the insurance company on your behalf. This formal submission initiates the claim process with your insurer.

Documenting Every Communication

Throughout the process, we document every communication with the insurance company. This thorough record-keeping ensures transparency and accountability.

Ensuring Compliance with Insurance Code

We monitor the insurance company's actions to ensure they follow all rules and regulations set forth by the insurance code. Any deviations are noted and addressed promptly.

Addressing Non-Compliance

If the insurance company fails to comply or attempts to undervalue your claim, we document any violations. This documentation strengthens your case and ensures the success of your claim.

Advocating for a Fair Settlement

We do not let insurance companies bully you into a smaller settlement. We negotiate fiercely on your behalf to secure the full compensation you deserve.

Support Until the End

We stand by you throughout the entire process, from the initial consultation to the final settlement. Our commitment is to ensure you receive the maximum possible compensation for your claim.

Ready to Maximize Your Settlement?

Contact us now for a free consultation and let our experts guide you through the claims process.

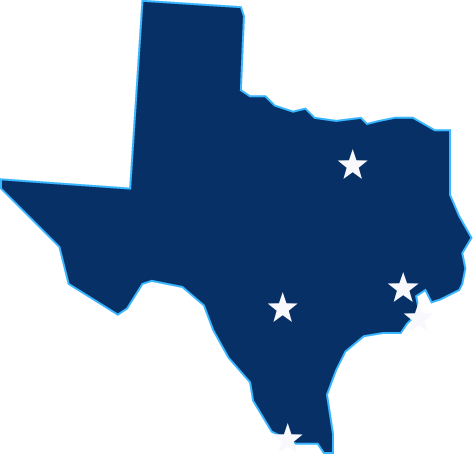

Where We Serve

At Claim Genius, LLC, we proudly serve clients throughout Texas, ensuring you receive expert assistance no matter where you are located. Wherever you are in Texas, our experienced team is ready to help you maximize your insurance settlement. Contact us today to see how we can assist you.

Our primary service areas include:

- Texas-primarily Rio Grande Valley

- Houston

- Laredo

- San Antonio

- Dallas

Frequently Asked Questions

A public adjuster is a licensed professional who represents policyholders in the preparation, negotiation, and settlement of insurance claims. Unlike insurance company adjusters, who work for the insurer, public adjusters advocate exclusively for the policyholder to ensure they receive the maximum possible compensation for their claim.

Hiring a public adjuster can significantly increase your claim settlement. They have extensive knowledge of insurance policies, claim processes, and documentation requirements, ensuring no detail is overlooked. Their expertise can lead to faster, fairer settlements, alleviating the stress and complexity of managing a claim on your own.

Public adjusters typically work on a contingency fee basis, meaning they receive a percentage of the settlement amount (10 % Fee). This ensures they are motivated to maximize your claim, as their compensation is directly tied to the amount you receive.

Yes, public adjusters are required to be licensed in most states. Licensing ensures they meet specific educational and professional standards, providing you with confidence in their qualifications and expertise.

Insurance company adjusters are employed by the insurance company and prioritize the insurer's interests. In contrast, public adjusters work solely for the policyholder, focusing on maximizing the claim settlement based on the policyholder's coverage and damages.

It's best to contact a public adjuster as soon as you experience a loss or damage covered by your insurance policy. Early involvement allows the public adjuster to manage the entire claims process, from initial documentation to final settlement, ensuring a comprehensive and accurate claim submission.

Public adjusters can handle a wide range of claims, including residential and commercial property damage caused by fire, water, wind, hail, and other disasters. They also assist with complex claims, business interruption claims, and other insurance-related issues.

When choosing a public adjuster, look for someone with extensive experience, positive client testimonials, and a strong track record of successful claim settlements. Verify their licensing and ask for references to ensure they have the expertise to handle your specific type of claim.

Yes, a public adjuster can assist in reviewing and appealing denied claims. They will analyze the denial reasons, gather additional evidence, and advocate on your behalf to overturn the denial and secure a fair settlement.

To get started, contact a reputable public adjuster for a consultation. They will assess your situation, explain the process, and outline how they can assist you in managing and maximizing your insurance claim.

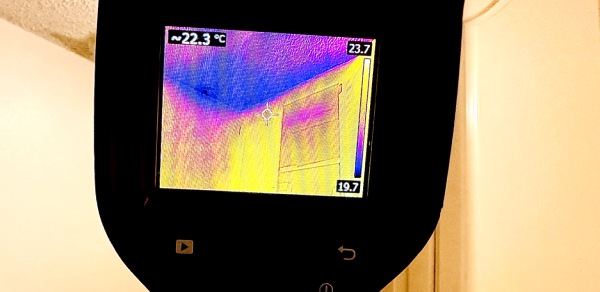

advanced imaging

Get in Touch

Have questions or need assistance with your insurance claim? We’re here to help. Contact us today to schedule your free consultation and discover how Claim Genius, LLC can maximize your settlement.

Testimonials

Maria Hernandez

Claim Genius helped us get a much bigger settlement than we expected after our home had water damage. They made the whole process easy. Thank you!

Jose Olivarez

Our church had a water loss, and Claim Genius increased our claim from $70,000 to $315,000. They handled everything. Highly recommend!

Isabella Martinez

I was overwhelmed after the storm, but Claim Genius made it all simple. They fought for a fair settlement and kept me updated. Thank you so much!

Timothy Simmons

Claim Genius got us a settlement that covered all our losses. They were professional and dedicated. Very grateful for their help.

Sofia Gomez

After our fire, Claim Genius guided us through the claims process. They handled everything and got us fully compensated. Great job!

VG

Very Knowledgeable, timely and quality service.

Subscribe to our newsletter

Stay updated with our latest newsletter release.